Officials of Wespath, the agency that administers UM pension funds and benefits, are touting its efforts to be environmentally friendly.

JIM PATTERSON

UM News

The church agency that administers United Methodist pension funds and benefits programs is making progress toward improving the effects of church investments on the environment, but some believe changes are coming too slowly.

Investment in fossil fuel companies is the main issue, says a United Methodist advocacy group. Wespath holds shares of oil companies including Chevron, ExxonMobil and Occidental Petroleum.

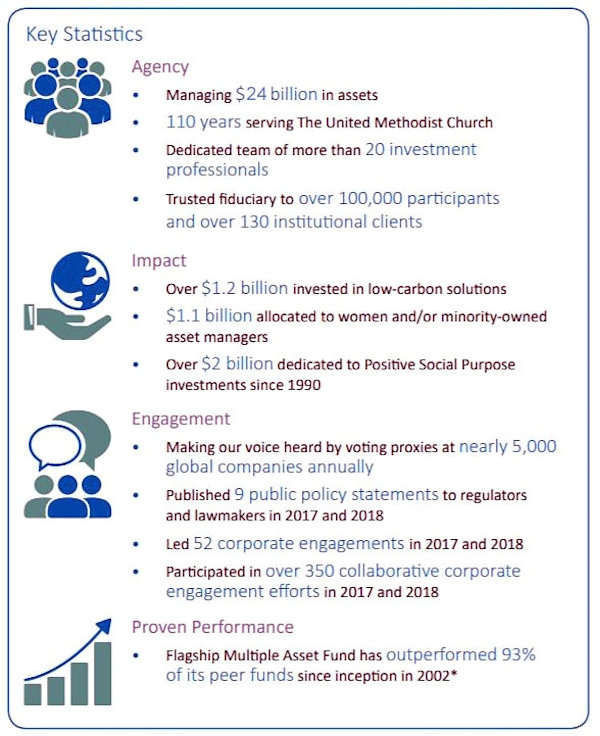

Wespath, based in Glenview, Illinois, is a nonprofit agency that has been serving The United Methodist Church for more than a century. Together with its subsidiaries, Wespath invests more than $24 billion in assets on behalf of more than 100,000 participants and more than 130 United Methodist-affiliated institutions.

“We believe that the global transition to a low-carbon economy is happening, and that this transition is going to create winners and losers across countries, industries and companies,” said Anita Green, director of sustainable investment services for Wespath Benefits and Investments. “As a prudent fiduciary, we need to be managing those risks.”

Green spoke July 11 at the 2019 United Methodist Creation Care Summit at the Scarritt Bennett Center in midtown Nashville. Wespath released a sustainability investment report in June. The report includes an account of the agency’s climate action plan.

“We believe a sustainable economy promotes healthier financial markets and resilient companies, and ultimately, greater financial security for those we serve,” said Barbara Boigegrain, top executive of Wespath, when the sustainability investment report was released June 24.

But Wespath is not moving quickly enough with divestment, said Marie Kuch-Stanovsky, a volunteer for Fossil Free UMC, a group of United Methodists who want the denomination to get out of the fossil fuel business altogether.

“As the largest faith-based pension fund in the world, the most impactful thing Wespath can do to promote a low-carbon future is fully divest from fossil fuels,” Kuch-Stanovsky said.

“As long as we remain invested in the fossil fuel industry, our United Methodist dollars perpetuate a root cause of the catastrophic harm of climate change. Divestment offers a way to live out our Christian calling, mitigate financial risk and create the systemic change needed for a thriving sustainable future.”

Climate change has long-term consequences. According to the Union of Concerned Scientists, these include more frequent and extreme heat, rising seas and increased flooding, longer and more damaging wildfire seasons, more destructive hurricanes, a longer and more intense allergy season and the spread of insect-borne diseases.

In 2017, Wespath added an environmental item to its list of beliefs that help guide where money is invested. Since 2014, the agency has placed some limitations have been placed on investment into thermal coal across every Wespath fund, Green said. In 2018, one equity and two bond funds were launched that are 100% fossil fuel free.

“We’ve also placed some investments in sustainable forestry, agribusiness and supporting off-grid renewable energy in developing nations,” Green said.

Investment managers who offer low-carbon portfolios have been hired, and possible company investments are evaluated on how well they are preparing for a low-carbon economy.

“We are using this strategy to reward the companies that are doing a better job of preparing by allocating more capital to those companies and then … allocating less capital to companies that are less prepared,” Green said.

“Wespath has invested $750 million in U.S. and international equity funds who are investing with preserving the earth in mind,” Green said. The agency has invested 6% of its total $24 billion in assets in companies devoted to low carbon emissions.

The next step is to spread the strategy to more asset classes and see if it continues to work, she said.

Wespath is also trying to influence fossil fuel companies where it has investments. In 2017, Wespath filed a shareholder resolution with Occidental Petroleum asking for better climate risk disclosures. The resolution passed, the first time such a resolution has been successful in the U.S.

“The Occidental Petroleum disclosures show just how low the bar is for the fossil fuel industry,” Kuch-Stanovsky said. “They have merely agreed to release information, not to any actual change in their harmful business model.”

Occidental Petroleum’s report specifies that the company will use their fossil fuel reserves as long as it is legal and there is demand. Company officials say in the report that they will only rely on lower-emission fossil fuel options if the markets or governments require it.

“These are reserves that climate scientists say must stay in the ground to curtail climate change,” Kuch-Stanovsky said. “The seat at the table in the fossil fuel industry is not creating the systemic and social change needed for a truly low-carbon future.”

At its Illinois headquarters, Wespath has a “Green Team” that follows through on the agency’s environmental direction.

“Earlier this year we launched a composting program at Wespath,” Green said. “With our composting in addition to the recycling that we’re doing, we estimate that we’re diverting about 70% of our waste from the landfill.”

After consulting with its electricity provider, the Wespath facility is powered by 100% green energy.

But more expansive progress will require systemic changes, Green pointed out.

“The longer that the world delays action, the more drastic the action needs to be,” she said. “The more drastic the action needs to be, the more volatility is going to be built into the financial markets and that means we will have more volatility in our pension plans, which of course we do not want.”

Last Updated on October 31, 2023