Students! Applications are now open for spring loans from The United Methodist Church.

NASHVILLE, Tenn., November 29, 2017 – Student loan debt is not always avoidable for those pursuing higher education. Interest rates for educational loans can vary from lender to lender, and federal student loan interest rates have been increasing year-over-year.

Thankfully, United Methodist students do not have to worry about increasing interest rates. Through its Office of Loans and Scholarships, the General Board of Higher Education and Ministry (GBHEM) offers United Methodist students the lowest interest for student loans in the U.S.

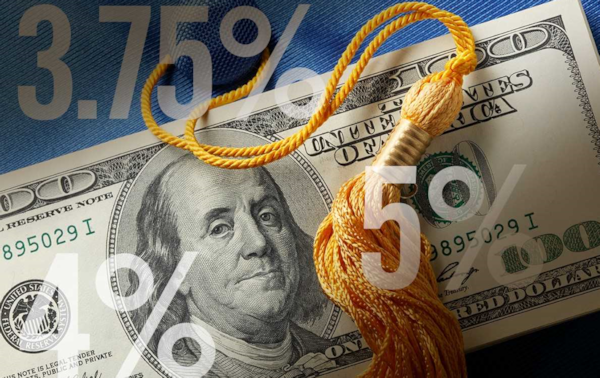

GBHEM loan interest rates range from 3.75 percent to 5 percent (pending the deferment option chosen) compared to federal loan interest rates that range from 4.45 percent to 7 percent. “GBHEM is proud to offer United Methodist students lower loan interest rate options to minimize debt levels. Higher interest rates and lengthened repayment periods for lower monthly payments increases debt levels,” explained Allyson Collinsworth, executive director of the Office of Loans and Scholarships at GBHEM.

United Methodist loan rates are:

- 3.75 percent fixed for the Smart Loan non-deferred rate, in which the student begins repayment within the month after the loan is disbursed.

- 4 percent fixed deferred rate for students attending a United Methodist college or university. No early repayment is required for this rate.

- 5 percent fixed deferred rate for United Methodist attending a non-United Methodist institution with no early repayment required.

Current Federal Student loan rates (based on loans disbursed between July 1, 2017 and June 30, 2018) are:

- 4.45% fixed for Direct Subsidized Stafford Loans (Undergraduate Students)

- 4.45% fixed for Direct Unsubsidized Stafford Loans (Undergraduate Students)

- 6.00% fixed for Direct Unsubsidized Stafford Loans (Graduate or Professional Students)

- 7.00% fixed for Direct PLUS Loans (Parents and Graduate or Professional Students)

- 5.00% fixed for Perkins Loans (Undergraduate and Graduate or Professional Students)

Under legislation passed in 2015, federal student loan interest rates are tied to the annual 10-year U.S. Treasury note auction and will be adjusted each year.

“We strive to maintain scholarships and low-interest loans through church offerings, donations and endowments from forward-thinking members to ensure our students have an opportunity to pursue the educational track they choose,” Collinsworth said.

U.S. students owe more than $1.45 trillion in student loan debt—spread out among about 44 million borrowers. Student loan debt even outranks credit card debt by $620 billion. On average, class of 2016 graduates have $37,172 in student loan debt, up nearly six percent from $35,200 in 2013.

“We encourage all students to research and understand what options are available to them through loans and scholarships,” said Collinsworth. “Knowledge is power and making wise financial decisions concerning your education can relieve future financial burdens and stress.”

Students may borrow up to $5,000 per calendar year for a maximum total of $20,000 during a four-year college career. United Methodist student loan rates for 2017-2018 academic year are no more than 5 percent, with the lowest rate at 3.75 percent.

Spring loan applications are open December 13, 2017 to May 2, 2018. Scholarship applications for the 2018-2019 academic year open January 3, 2018 – March 7, 2018.

For more information about the low-interest student loans and scholarships available through GBHEM, visit www.gbhem.org/loansandscholarships.

Last Updated on October 17, 2022